Guide to Getting a Mortgage

Nearly 6.5 million homes are sold every year, according to Statista. If you are looking to join the ranks of homeowners this year, and are like many home buyers, you likely will be applying for a mortgage before you find the next place to call home.

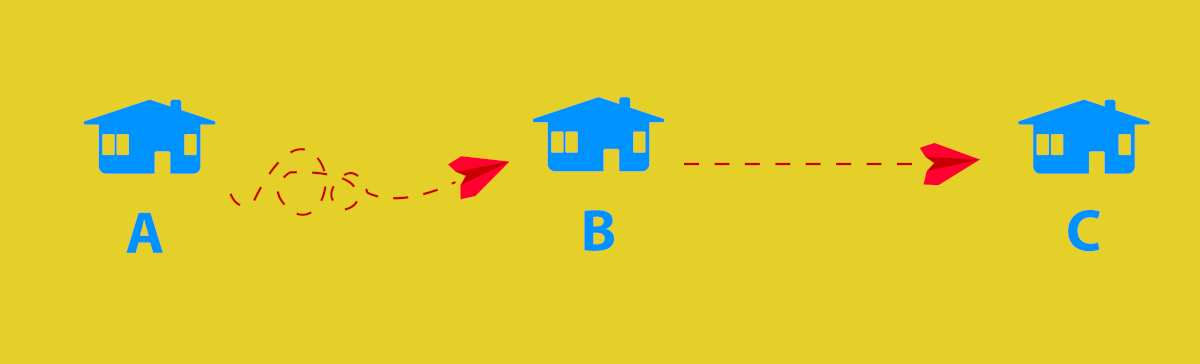

The process of applying for a mortgage usually includes the same four steps:

Step #1 - Evaluate your finances: Begin by assessing your financial situation, including your income, expenses, and credit score. This will help you determine how much you can afford to borrow and ensure you're in a good position to qualify for a mortgage.

Step #2 - Understand mortgage options: Explore various mortgage types, such as fixed-rate, adjustable-rate, or government-backed loans, along with specific terms like prepayment options. Consider the pros and cons of each option and find the best fit for your needs and financial goals.

Step #3 - Get pre-approved: Obtaining a mortgage pre-approval from a lender can mean the difference between an accepted offer and the disappointment of your dream home slipping away. This step involves providing your financial information and undergoing a preliminary credit check.

Step #4 – Find a home: After obtaining your pre-approval letter, it is time to partner with a knowledgeable real estate agent. Start looking for your dream home within your budget, obtain an appraisal, and request final mortgage approval based on the home you’ve chosen.

While the process mentioned above happens every day, there are a few additional steps you may want to take to improve your position before applying for a mortgage, such as:

Boost your credit score: A higher credit score can secure a better interest rate. Pay your bills on time, reduce existing debt, and avoid opening new lines of credit before applying for a mortgage. It may be worth waiting to making an offer until you reach a more advantageous credit score.

Save for a larger down payment: A larger down payment not only reduces your loan amount, but also improves your chances of approval. Aim to save at least 20% of the home's purchase price to avoid private mortgage insurance (PMI).

Get multiple loan estimates: Don’t limit yourself to just one mortgage option. Shop around for mortgage rates and terms from different lenders. Collecting multiple loan estimates will help you compare options and find the most favorable terms for your situation.

Organize your financial documents: This may seem like an obvious step, but many applicants waste countless days and weeks during the application process looking for financial documents, such as tax returns, bank statements, and pay stubs. Having these readily available will speed up the application process.

Securing a mortgage requires careful planning and consideration. By following the expected steps and taking a few extras into account, you'll be well-equipped to navigate the mortgage application process successfully. Remember to do your research, work on improving your credit score, and explore various loan options to find the best mortgage for your dream home. Good luck!

Featured Blogs

- Why Choosing an Independent Insurance Agent Could Be Your Best Decision Yet

- Autonomous Vehicles and Insurance: Adapting Policies for the Future of Driving

- The Critical Role of Life Insurance in a Comprehensive Personal Finance Strategy

- Protect Your Castle: Essential Tips for First-Time Homebuyers on Choosing Home Insurance

- Flu Season Survival Guide

- How to Create a Home Inventory for Insurance Claims

- Brown and White Eggs: What’s the Difference?

- DIY Disaster Preparedness Kit: Make your own disaster preparedness kit with these essentials to keep your property and family safe

- Understanding the Different Types of Property Insurance Coverage: Are You Fully Protected?

- The Benefits of Bundling: How Combining Policies Can Save You Money

- Is there such thing as Hurricane Insurance?

- The Impact of New Technology on Insurance

- Why Property Insurance Isn't Enough: Essential Property Preparedness Tips Every Homeowner Should Know

- Protecting Your Investments: The Role of Insurance in Wealth Management

- Rising Temperatures, Rising Risks: How Climate Change Affects Property Insurance

- Insurance Myth Busters: Debunking Common Misconceptions about Coverage

- Pool and Liability Insurance: Staying Safe and Protected around the Water

- The Evolution of Insurance: Trends and Innovations Shaping the Industry

- Fire Safety Awareness: Mitigating Risks and Ensuring Adequate Coverage

- The Future of Work

- Emergency Preparedness: How Insurance Can Provide Peace of Mind During Crises

- Scenarios that can lead to a voided Property Insurance policy

- Navigating Insurance Renewals: Tips for Reviewing Your Policies

- Summer Safety Tips: Protecting Your Property and Liability Risks

- Easy & Creative Ideas to Refresh Your Home for Summer

- Revamping Your Home? You May Need to Revamp Your Coverage

- How Milestones Can Affect Your Coverage Needs

- Safeguard Your Medicare Number: A Guide to Avoiding Fraud and Protecting Your Benefits

- Thinking of Renting Out Your Property? Consider These Liability Risks First

- How to Fall Back Asleep After Waking in the Middle of the Night

- Demystifying Mortgage Rates

- How to Improve the Air Quality in Your Home

- Should I Buy a Second Home?

- The Rise of Urban Gardening

- Tech-Enhanced Property Preparedness

- Fueling Your Mind with Brain-Boosting Foods

- Protecting Your Family's Financial Future

- Embracing Our Roles: Renewing Our Commitment to Sustainable Living

- Tips for a Stress-Free Tax Season Experience

- Spring cleaning your yard and home exterior

- Inspirational women who make the world a better place

- Marching Towards Financial Wellness: Tips for a Stronger Financial Future

- Spring Forward: Adjusting Your Routine for Daylight Saving Time

- Gratitude - Key to a Positive Mindset

- Smart Home Technology: How it Affects Your Property Insurance

- 3 Common Sense Things People Should Know

- The Rise of Eco-Friendly Homes: Sustainable Property Trends

- Unraveling the Mystery of the Extra Day

- Buying Your First Home? Tips and Insurance Considerations

- Financial Fitness in 2024: Budgeting and Saving Tips

- Assessing Your Assets

- New Year's Resolutions: Staying Committed Year Round

- The Magic of Christmas Traditions

- How to be a Time Management Whiz During this Busy Season

- Managing Home Maintenance: Year-Round Checklists for a Well-Maintained Property

- Is Owning Your Home in Retirement Wise? Exploring the Pros and Cons

- What kind of mortgage is right for you?

- How Routines are Essential to Accomplishing Goals

- How to Experience Positive Aging (8 Tips)

- How much should you actually have in savings?

- When travel insurance can go wrong

- 10 most dangerous items you might have in your home

- How to Build Sustainable Wealth

- Common Estate Planning Mistakes

- Enhancing Resilience as We Age

- The best herbs to grow for beginners

- Is celebrating your 100th birthday no longer a dream?

- Senior Travel: Should you consider buying travel medical insurance?

- Summer Workouts for Your Dose of Vitamin D

- Do I Need a Financial Advisor?

- Music and Your Wellbeing

- Are You Emotionally Ready for Retirement?

- How to Dispose of Unused Medications

- Guide to Getting a Mortgage

- Aging and Our Body’s Ability to Heal Itself

- What is Credit Health Insurance? (Copy1)

- What is Credit Health Insurance? (Copy)

- What is Credit Health Insurance?

- Waking Up to the Impact of Insomnia

- Electric Car: To Buy or to Lease?

- What experts say about raising the retirement age

- How are the proceeds of a life settlement taxed?

- Sharing the Road with Cyclists

- Auto Rates on the Rise

- What Every Renter Needs to Know about Renters Insurance

- Does Uber Insurance Cover Passengers?

- Living Your Best Life After 60

- New Coverages for Home Insurance

- 5 Insurance Mistakes to Avoid